Implementing HB 1406

Contact: Carl Schroeder, Shannon McClelland

Printable version

In the 2019 legislative session, the state approved a local revenue sharing program for local governments by providing up to a 0.0146% local sales and use tax credited against the state sales tax for housing investments, available in increments of 0.0073%, depending on the imposition of other local taxes and whether your county also takes advantage. The tax credit is in place for up to 20 years and can be used for acquiring, rehabilitating, or constructing affordable housing; operations and maintenance of new affordable or supportive housing facilities; and, for smaller cities, rental assistance. The funding must be spent on projects that serve persons whose income is at or below sixty percent of the median income of the city imposing the tax. Cities can also issue bonds to finance the authorized projects.

This local sales tax authority is a credit against the state sales tax, so it does not increase the sales tax for the consumer. There are tight timelines that must be met to access this funding source – the first is January 28, 2020 to pass a resolution of intent. The tax ordinance must then be adopted by July 28, 2020 to qualify for a credit.

Timing considerations

HB 1406 makes a distinction about whether a county or a city adopts the tax first. For cities, the amount you are eligible to receive will not change in either event. But for counties, if they adopt the tax before their cities, they will potentially be eligible to receive more revenue over the course of the twenty years of revenue sharing. Because of this, many cities are working with their counties to sequence their ordinances in order to maximize housing resources into the region.

Don’t miss out on up to 20 years of shared revenue for affordable housing.

The following information is intended to assist your city in evaluating its options and timelines. It is not intended as legal advice. Check with your city’s legal counsel and/or bond counsel for specific questions on project uses and deadlines for implementation.

Eligibility to receive shared revenues

- The state is splitting the shared resources between cities and counties. However, cities can receive both shares if they have adopted a “qualifying local tax” by July 28, 2020. Qualifying taxes are detailed below. Cities who are levying a “qualifying local tax” by July 28, 2019, the effective date of the new law, will receive both shares immediately once they impose the new sales tax credit.

- If a city does not implement a qualifying local tax by the deadline, they can still participate in the program if they meet the other deadlines but will be eligible for a lower credit rate.

- A city can adopt the sales tax credit before designating how the funds will be used once collected.

Qualifying local taxes

The following are considered “qualifying local taxes” and, if levied, give the city access to both shares of the tax credit (i.e. 0.0146% rate instead of the single share rate of 0.0073%):

- Affordable housing levy (property tax) under RCW 84.52.105

- Sales and use tax for housing and related services under RCW 82.14.530. The city must have adopted at least half of the authorized maximum rate of 0.001%.

- Sales tax for chemical dependency and mental health (optional .1 MIDD) under RCW 82.14.460

- Levy (property tax) authorized under RCW 84.55.050, if used solely for affordable housing

Think of the “qualifying local tax” as a multiplier or “doubler.” It gives the city access to double the tax credit even when the county chooses to participate in the program.

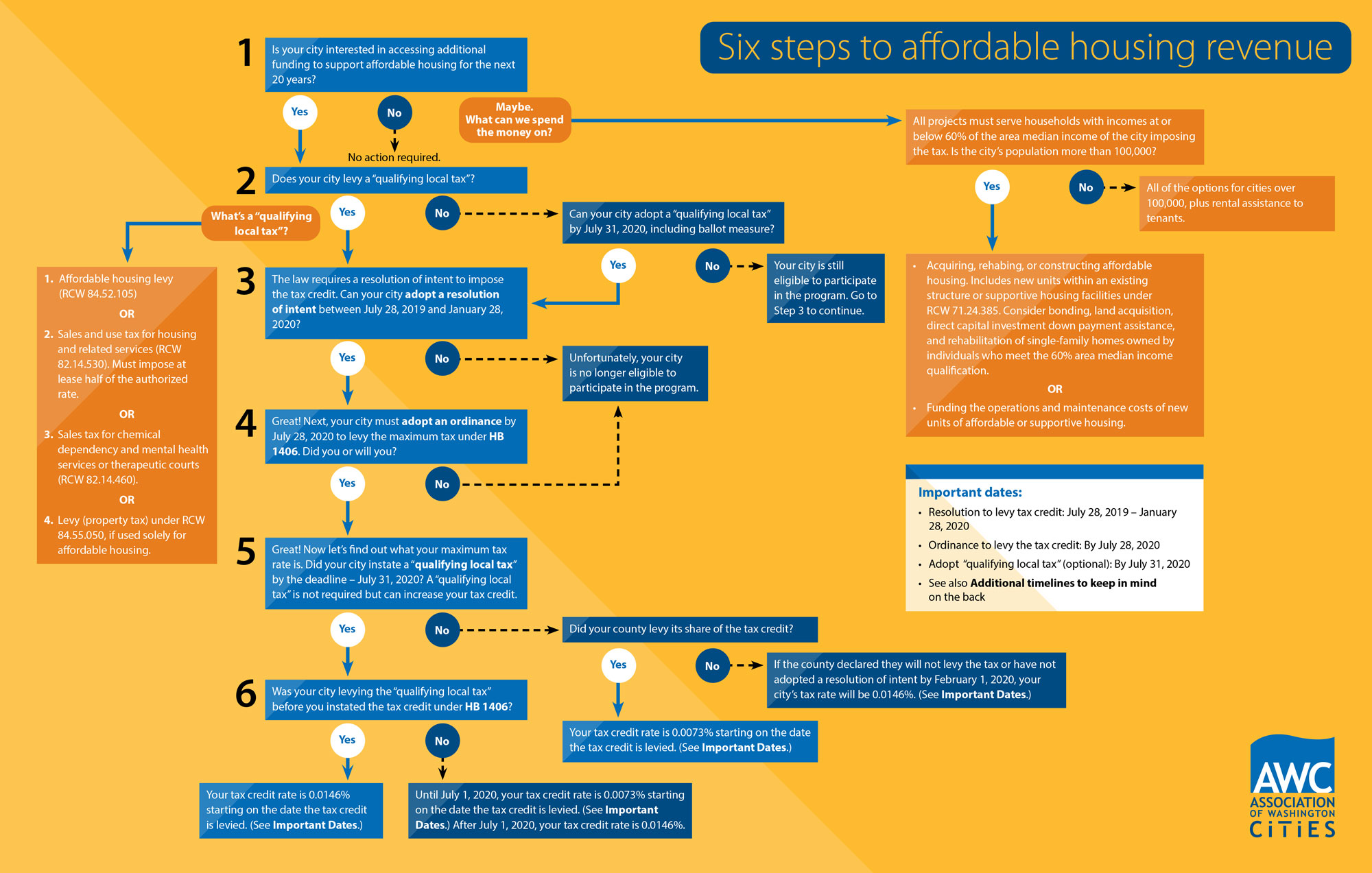

Click image to open a larger version

Deadlines to participate

- Resolution to levy tax credit: July 28, 2019 – January 28, 2020

- Ordinance to levy the tax credit: By July 28, 2020

- Adopt “qualifying local tax” (optional): By July 28, 2020

Tax credit rate examples

|

Max tax credit rate under HB 1406

|

City with qualifying local tax

|

City without qualifying local tax

|

City doesn’t levy a tax credit, county does participate

|

County doesn’t participate, city participates but doesn’t have a qualifying tax.*

|

|

City

|

0.0146%

|

0.0073%

|

0.0%

|

July 2020: 0.0%

|

|

County

|

0.0%

|

0.0073%

|

0.0146%

|

0.0%

|

*We believe that this was an error in bill drafting. Please let us know if you are in this situation. We can work to address it in future legislative sessions.

Eligible uses of the funds

- Projects must serve those at or below 60% of the area median income of the city imposing the tax.

- Acquiring, rehabilitating, or constructing affordable housing, which may include new units of affordable housing within an existing structure or facilities providing supportive housing services. In addition to investing in traditional subsidized housing projects, this authority could potentially be used to provide for land acquisition, down payment assistance, and home repair so long as recipients meet the income guidelines.

- Funding the operations and maintenance costs of new units of affordable or supportive housing.

- For cities with a population at or under 100,000, the funds can also be used for rental assistance to tenants.

Additional timelines to keep in mind

- Department of Revenue (DOR) requires 30-days-notice of adoption of sales tax credits. The credit will then take effect on the first day of the month following the 30-day period.

- If your city is adopting a “qualifying local tax”, DOR requires 75-days-notice of adoption of sales tax increases. Local sales tax increases may only take effect on the first day of the first, second, or third quarter – not the fourth (April 1, July 1, or October 1).

- If your city is adopting a “qualifying local tax” remember to factor in the ballot measure process into the timeline, as these must be approved by the voters.

- If you are intending to bond the revenues for a project under this authority, check with your legal counsel and bond counsel about other deadlines that may apply to your city.

Frequently asked questions

- This program sounds very familiar. Didn’t a local option, affordable housing sales tax law pass a few years ago? Yes, but the new law has important differences. The Legislature passed HB 2263 in 2015 that authorized cities and towns to levy up to a 0.1% sales tax for affordable housing—but, importantly, only after voter approval. This sales tax levy is considered a “qualifying local tax” under HB 1406. Another important distinction is that the affordable housing sales tax from 2015 is an additional tax on the consumer, and not a credit on an existing state-imposed tax.

- Do we have to levy a “qualifying local tax” to participate? No. Your city is still eligible to participate in the program, but your tax credit rate will depend on whether the county participates in the program. See Tax credit rate examples chart to the left.

- Do we only have access to the program if the county declines to participate? No. A city can participate, and receive funds, even if the county participates. Unfortunately, if your city does not impose a “qualifying local tax” by the deadline and your county declines to participate, then you will not have access to funds after the first year, due to a drafting error in the bill. We don’t anticipate this scenario to occur, but please let us know if you find yourself in that situation. We will work with the Legislature to address it if this proves problematic. In all cases you must meet the program deadlines to participate. See Deadlines to participate.

- Does it make a difference at all if our county participates? Only if you have not adopted a “qualifying local tax.” If you have adopted a qualifying local tax” you can access the higher credit rate regardless of county participation. If you don’t have a “qualifying local tax” then you can only access the higher rate if the county does not participate.

- How is “rental assistance” defined? Does that include rent vouchers? The term “rental assistance” is not defined in the chapter 82.14 RCW; however, both federal and state housing programs use the term “rental assistance” to mean providing rent, security deposits, or utility payment assistance to tenants.

- Can we pool our revenue with another entity? Can we issue bonds or use the money to repay bonds? Yes! Cities can enter into an interlocal agreement with other local governments or a public housing authority to pool tax receipts, pledge tax collections to bonds, allocating collected taxes to authorized affordable housing expenditures, or other agreements authorized under chapter 39.34 RCW. Cities may also use the tax credit revenue to issue or repay bonds in order to carry out the projects authorized under the new law.

- Is the amount of tax credit we receive limited only by the amount of sales tax collected per year? No. The maximum amount will be based on state fiscal year 2019 sales.

- Does the tax credit program expire? Yes, the tax expires 20 years after the date on which the tax is first levied.

Disclaimer: The content of this website does not constitute legal advice and is not intended as a substitute for seeking the counsel of your city attorney.